With WholesaleX’s dynamic rules system and user roles, you can exempt tax for all users. But if you want to exempt tax for a specific user or user, you can do that easily.

There are two ways of doing this. One is from the user profile, and another way is using the dynamic rule system.

Let’s check both of them.

Tax Exemption from User Profile

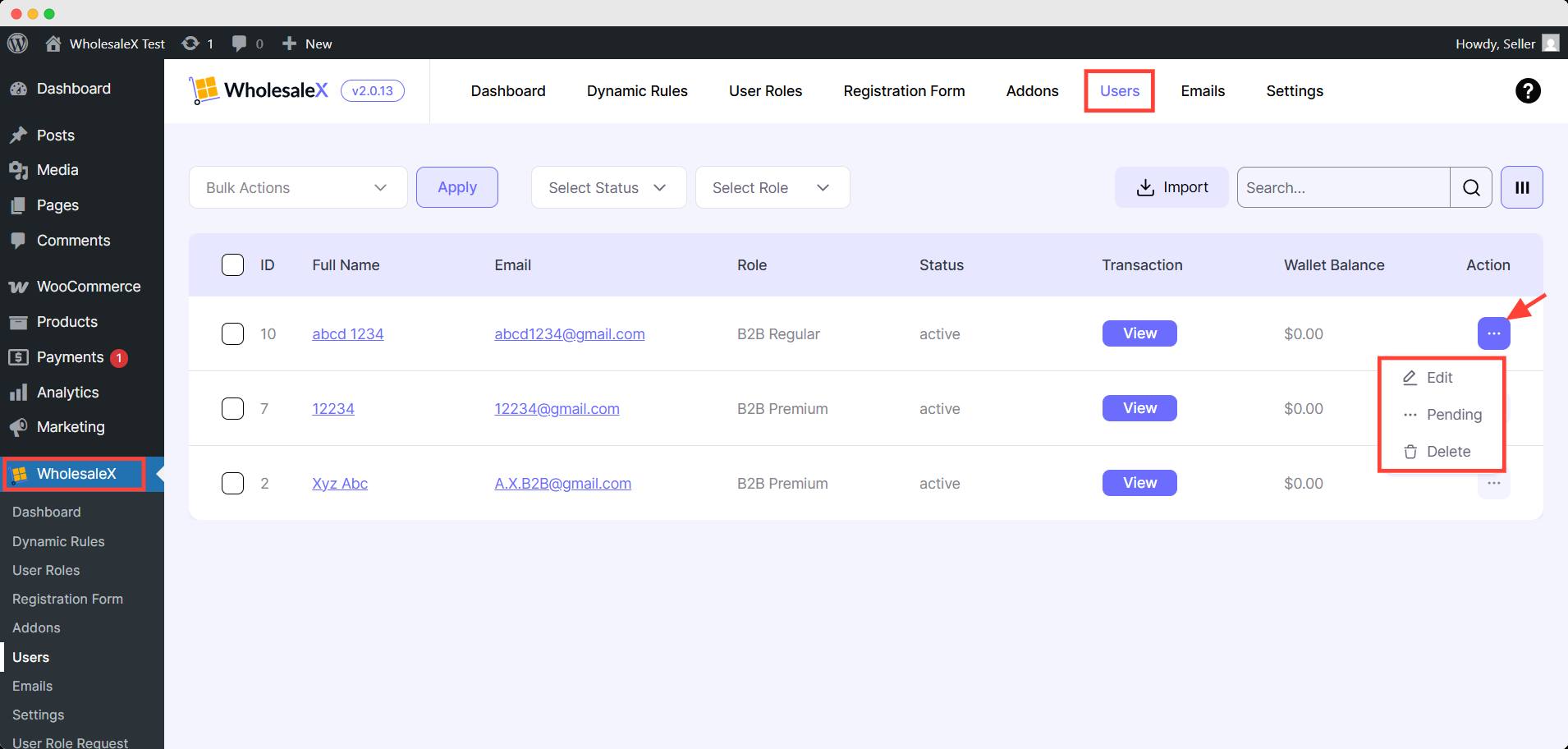

To enable tax exemption for a user in WholesaleX, go to WholesaleX → Users and click Edit from the three-dot option in Action column.

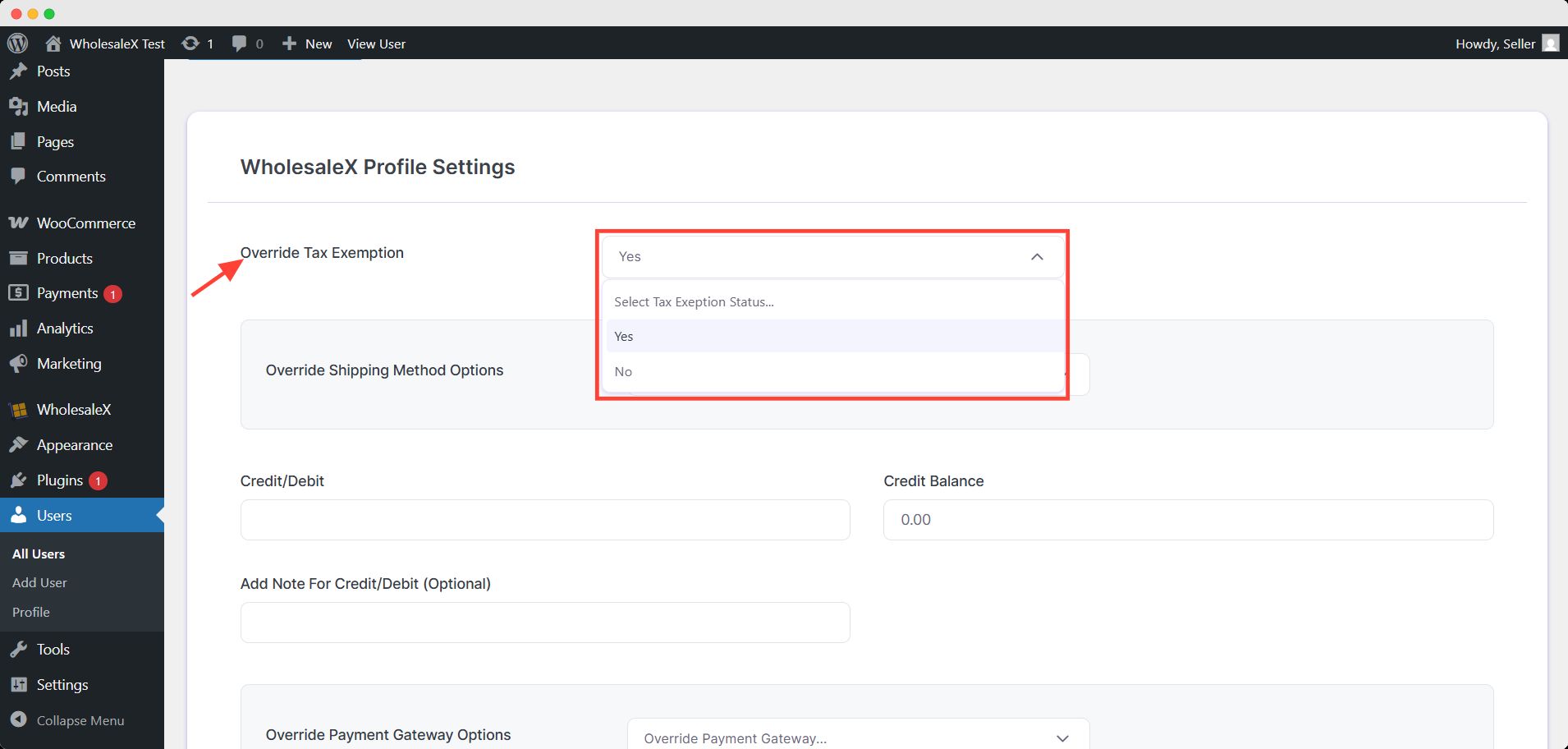

It will take you to the user profile setting page.

Now, scroll down to the WholesaleX Profile Settings section. Under Override Tax Exemption, set Tax Exemption to Yes from the dropdown.

Then scroll again to the bottom and click Update User to save the changes.

And that specific user will be exempted from tax.

Tax Exemption from Dynamic Rules

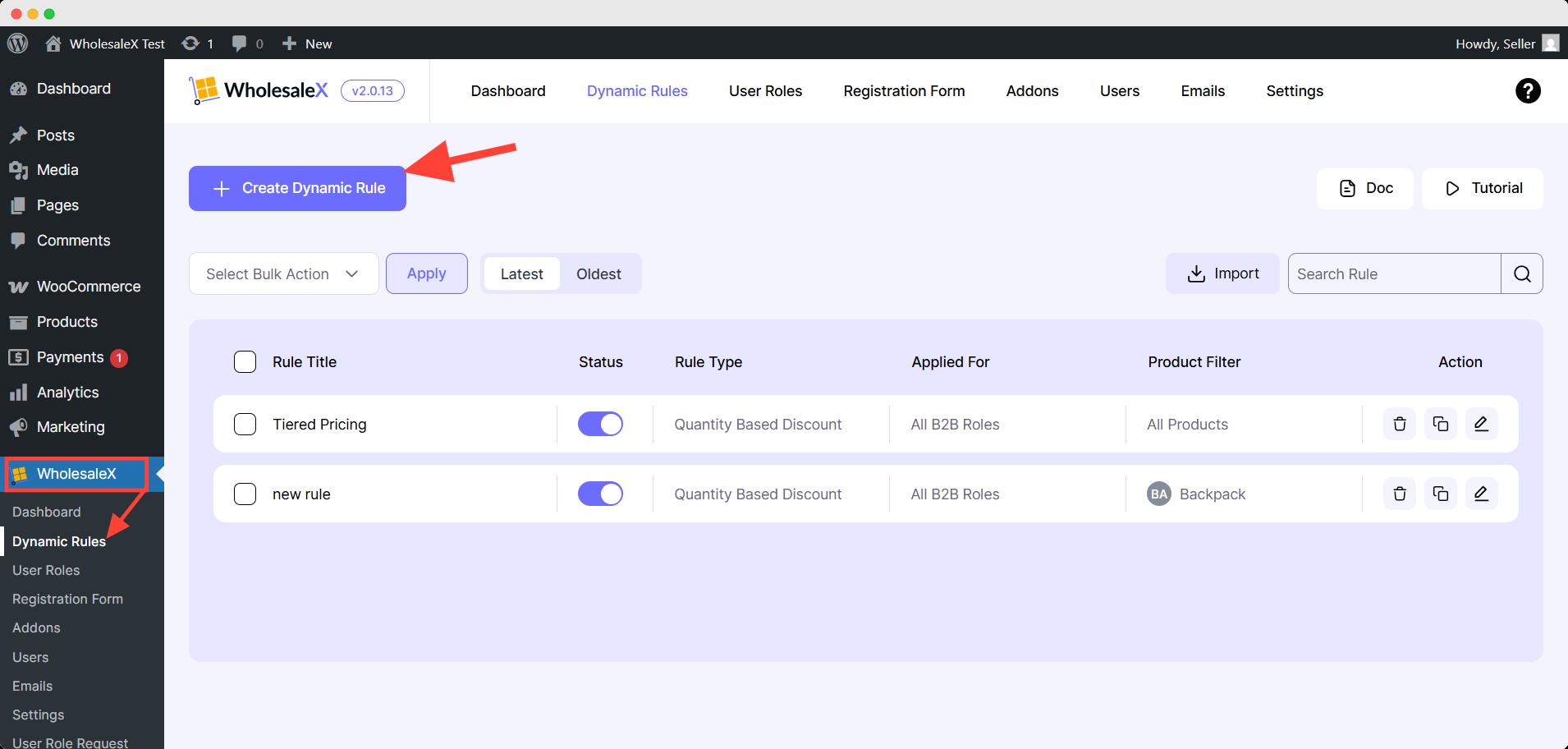

Go to WholesaleX → Dynamic Rules and click the Create Dynamic Rule button.

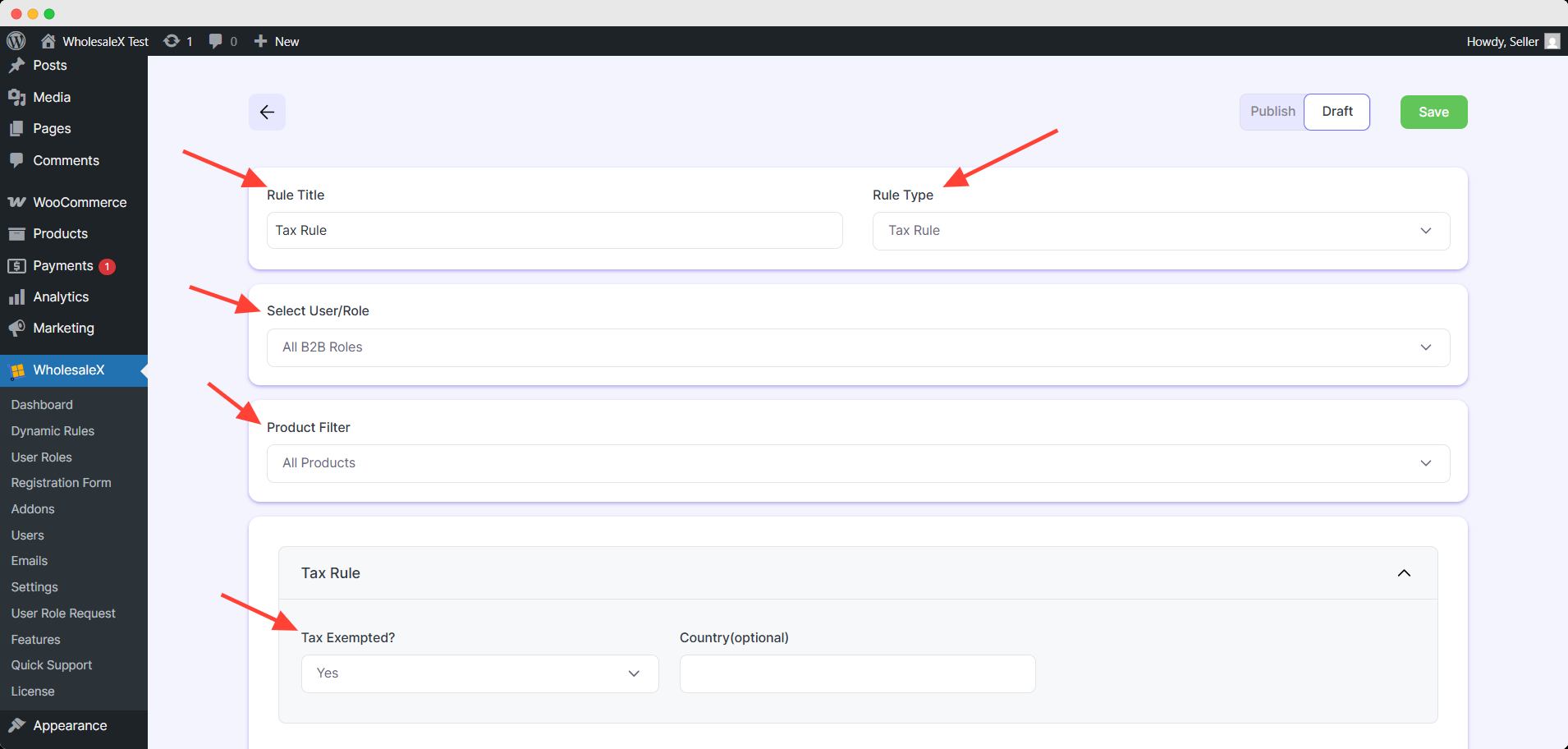

Give your rule a name and set the Rule Type to Tax Rule.

Under User/Role, choose Specific Users, and Add the desired user(s) in the Select Users field. Set the Product Filter to All products or as needed.

In the Tax Rule section, choose Yes from the Tax Exempted? dropdown. Finally, toggle the publish button on and save the rule.

And that’s how you can exempt tax for a specific user(s).

You will find detailed step by step process in our resouce doc about Tax Rule.

We suggest you use the first option if you need to exempt tax for a single user. And if you want to give it to multiple users, use the dynamic rule system.