Value Added Tax (VAT) is a common aspect of purchasing goods and services in the UK. But, there are exemptions in place for individuals with disabilities.

According to Census 2021, a smaller proportion but a larger number of people were disabled. A total of 17.7% of the total population in the UK is disabled. While this might seem very low, the count has reached 9.8 million individuals.

The UK government provides VAT relief to the disabled. This means entitled disabled persons can buy specific product/s vat-free.

- Do you have a WooCommerce store or website?

- Do you sell products in the UK which are catered towards the disabled?

- Do you want to add disability VAT exemptions in your WooCommerce store?

This article will guide you on how to add Disability VAT Exemption to your WooCommerce store using WholesaleX.

What is Disability VAT Exemption?

People with particular disabilities can get VAT exemption on certain products. This is a law under the UK financial support system. People with particular disabilities can get VAT exemption on certain products. This is a law under the UK financial support system. This law was made to help people in need of special care.

Qualification of Disability VAT Exemption?

To qualify for Disability VAT Exemption in the UK, individuals must have a disability or a long-term illness. The disability should be substantial and permanent, affecting the person’s ability to perform daily activities. Individuals with disabilities should make sure they meet the criteria to take advantage of VAT exemption.

Also, you will not be charged VAT on:

- The installation and any extra work needed as part of this.

- Repairs or maintenance.

- Spare parts or accessories.

Note: The product and the disability must qualify for a disability VAT exemption.

According to the The VAT Act 1994 (UK):

- Section 30 holds that goods and services specified in Schedule 8 of the Act are zero-rated.

- Section 29A holds that goods and services specified in Schedule 7A to the Act are reduced-rated.

- Schedule 8, Group 12 (as amended by SI 1997/2744, SI 2000/805, 2001/754, 2002/1397, and 2002/2813) specifies the zero-rated goods and services explained in this notice.

- Schedule 7A, Group 10 specifies the reduced-rated goods and services explained in this notice.

*SI (Statutory Instruments) is a common form of ruling from the UK Govt.

What Category of Products Can You Get VAT Exemptions?

Disability VAT Exemption applies to the products that help with mobility and communication. The UK government provides a list of eligible items that qualify for this exemption. These items help in daily living.

Here’s a table to help you get through the products:

| Product Category | Details | Detailed Link |

|---|---|---|

| Adapted Motor Vehicles | Modified car, light van, multi-passenger vehicle for disabled, motorhomes. | See Details |

| Boats | Boats that includes: ramp for wheelchairs, lifts for wheelchair movements, specialized washing and lavatory facilities, specially equipped galley and sleeping areas, handrails, wheelchair clamps, adapted steering or other controls. | See Details |

| Building and Construction | Ramps, widening doorways, passages, bathrooms, washrooms, lavatories, lifts. | See Details |

| Emergency Alarms | Telephones, internal communication systems, intruder alarm, CCTV. | See Details |

| Hydrotherapy Pools | Pool that includes: sited indoors, a lip raised to wheelchair height, railings with different height, shallow rising steps, mobility hoist, special non-slip floor, environmental control system. | See Details |

| Low Vision Aids | Spectacle mounted low vision aids, technical aids for reading and writing, closed circuit video magnification equipment. | See Details |

| Medical and Surgical Appliances | Artificial limbs, artificial respirators, heart pacemakers, leg braces, neck collars, oxygen concentrators, renal hemodialysis units, specialist clothing, specialist footwear, wigs. | See Details |

| Mobility Scooters | Basic wheelchairs, mechanically propelled carriages (4mph – 8 mph) | See Details |

| Daily Necessity Equipment | Adjustable beds, chair or stair lifts, hoists and lifters, sanitary devices. | See Details |

| Computational Devices | Desktops, laptops, tablets, smartphones, e-readers. | See Details |

| Part Accessories | Accessory parts of the mentioned goods above. | See Details |

| Repairing Facilities | Repairing or maintenance of the mentioned goods above. | See Details |

How to Add Disability Vat Exemption with WholesaleX?

So, now let’s show you how to add disability VAT exemption in your WooCommerce Store with WholesaleX.

Video Tutorial (Check it Out!)

Here’s a video tutorial to help you out with the process:

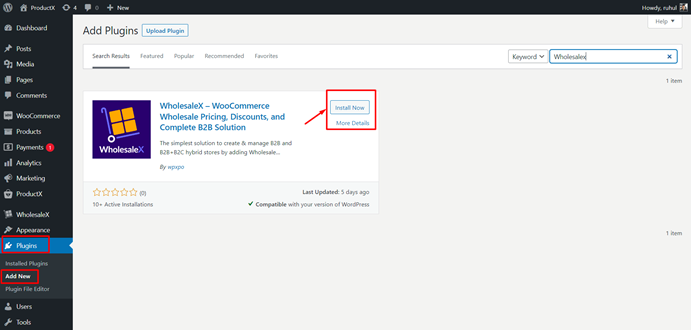

Installing WholesaleX

The first step is to install and activate the WholesaleX plugin on your WooCommerce store. You can easily find WholesaleX on the WordPress plugin repository and install it with just a few clicks.

To do this:

- Go to the plugin section in your WordPress dashboard.

- Click on “Add New“

- Search for “WholesaleX“

- Install and activate the plugin.

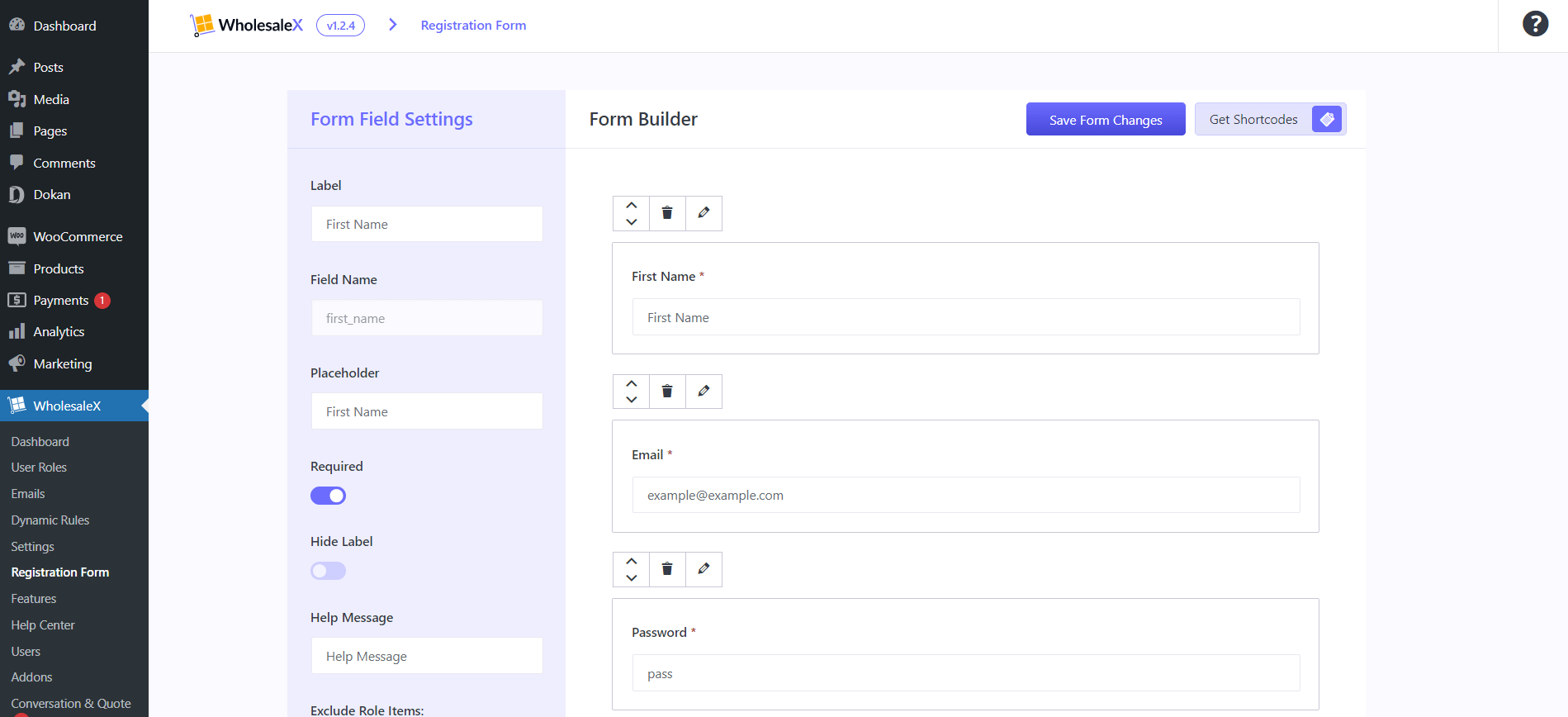

Creating a Custom Registration Form

With WholesaleX, you can create a custom registration form with a section for users to declare their eligibility for Disability VAT Exemption. This form can be designed to collect all the necessary information required to validate their exemption status.

Step 1: Go to Form Builder

After activating WholesaleX, go to the Registration Form section within WholesaleX on your site’s dashboard. You’ll find a basic form with primary fields.

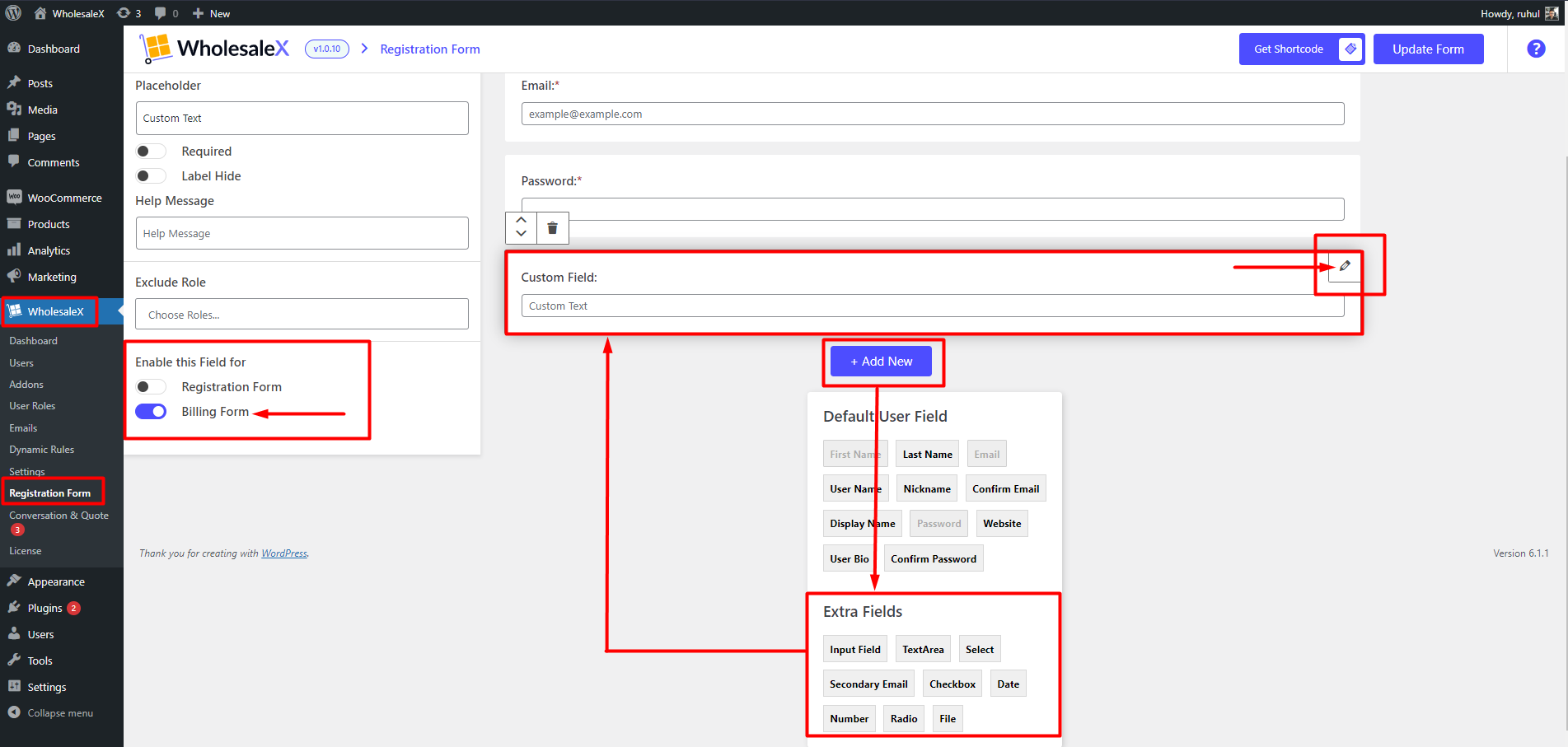

Step 2: Add Custom Fields

You can add custom fields by clicking “Add New.” WholesaleX provides various field types, including predefined and custom options. For example, you can add a custom Tax/VAT number field by selecting the “Number” field type, changing labels and placeholders, and assigning a name.

Each field is configurable individually. By clicking on a field, you can access various configuration options. You can make fields required, hide labels, add helpful text for users, and even hide fields based on user roles.

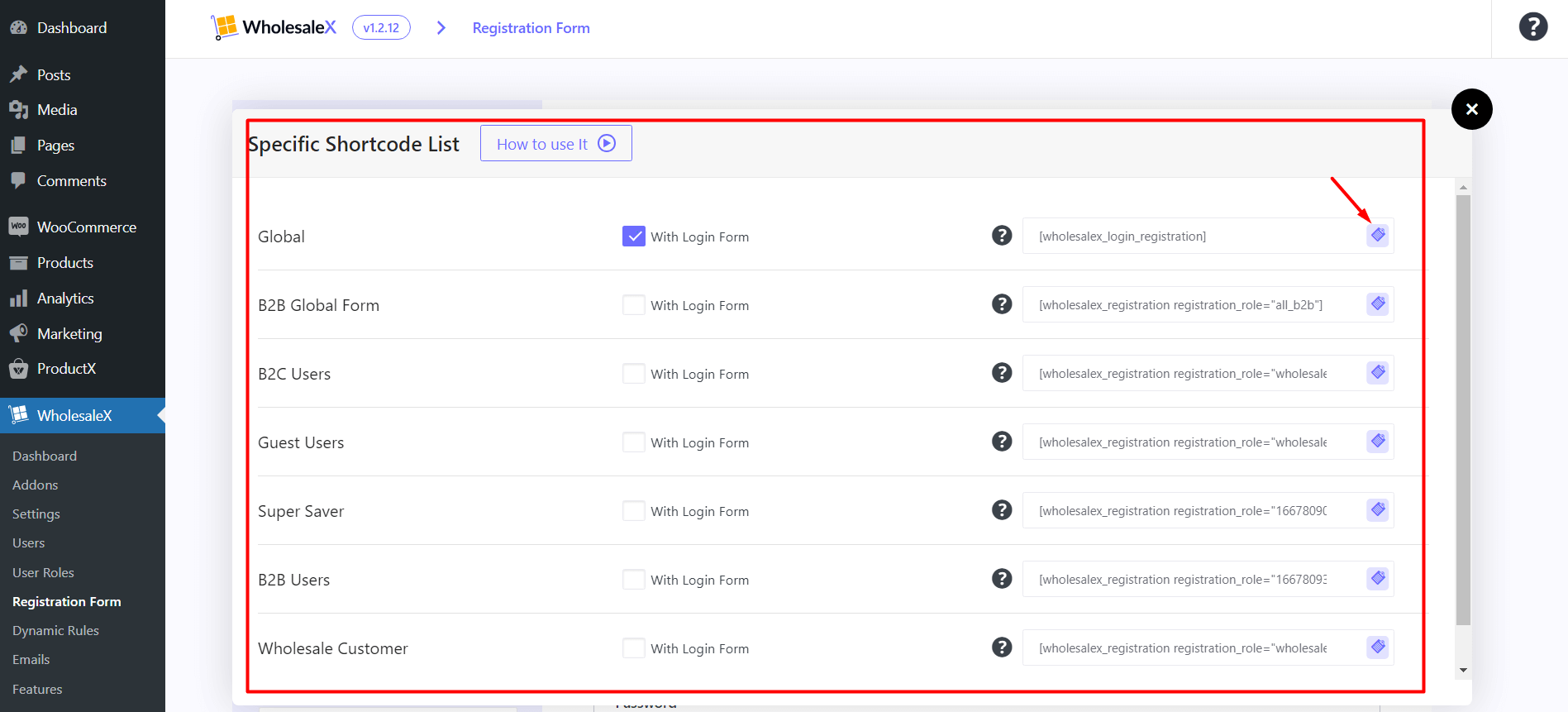

Step 3: Get the Shortcode

Once your form is configured, you can generate a shortcode to create a custom registration and login page. Click “Get Shortcode” and select the global registration form shortcode. Copy the shortcode.

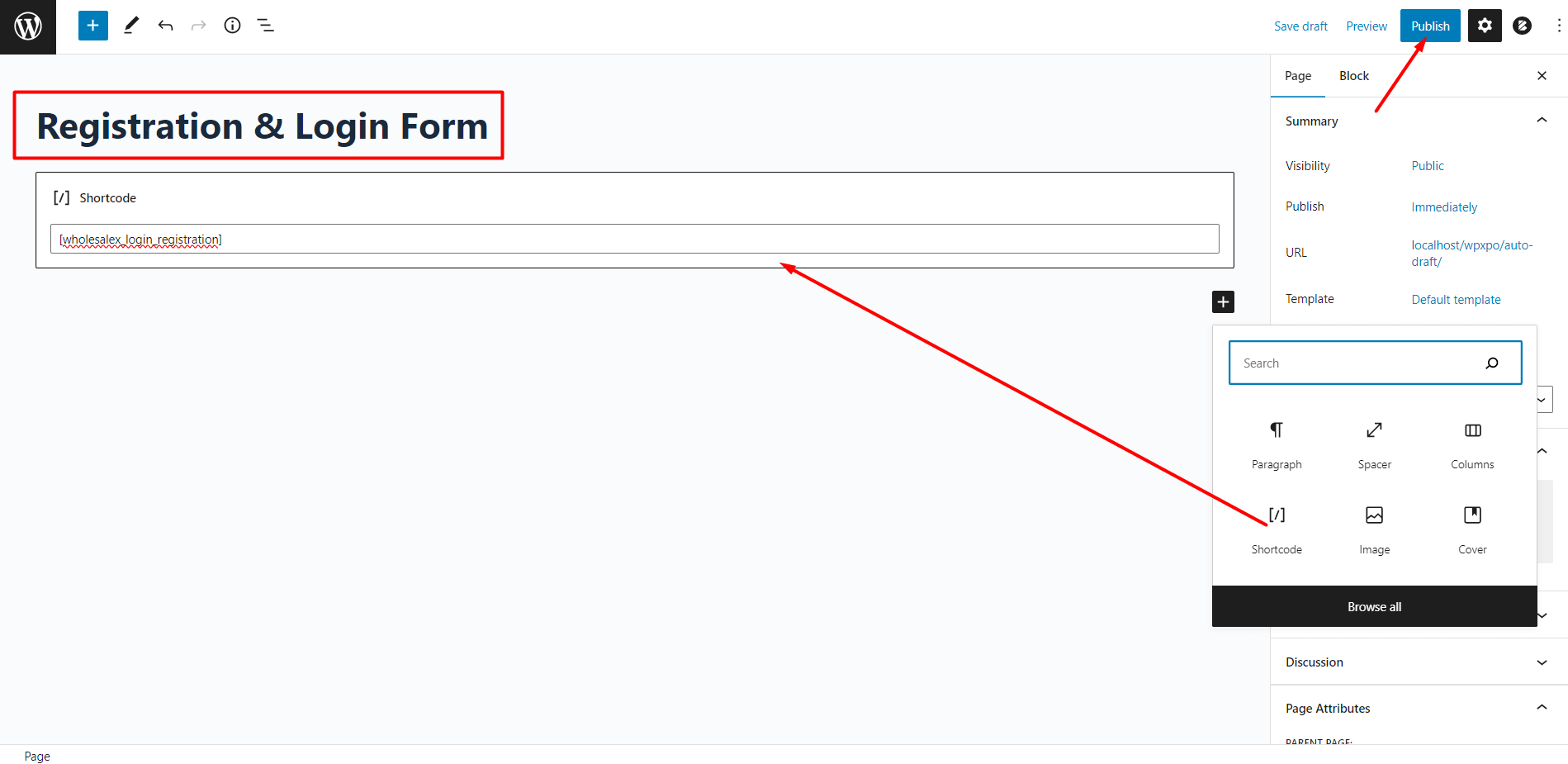

Step 4: Add Shortcode to a Page

Now, create a new page (or edit an existing one) to display the form. Add the shortcode block to the page, paste the shortcode, publish it, and your custom registration form is ready.

Creating a VAT disability exemption with WholesaleX is a straightforward process that allows you to customize your WooCommerce site registration for disability VAT exemption.

You can also check out the detailed blogpost on how to create a custom registration form.

Creating User Role

Once you have the registration form set up, create a specific user role for individuals who qualify for Disability VAT Exemption. This user role will help you differentiate these users from regular customers.

WholesaleX allows you to create user roles to your specific needs. This makes WholesaleX ideal for managing roles for disabled customers who are eligible for tax exemption. Here’s how to create user roles for this purpose:

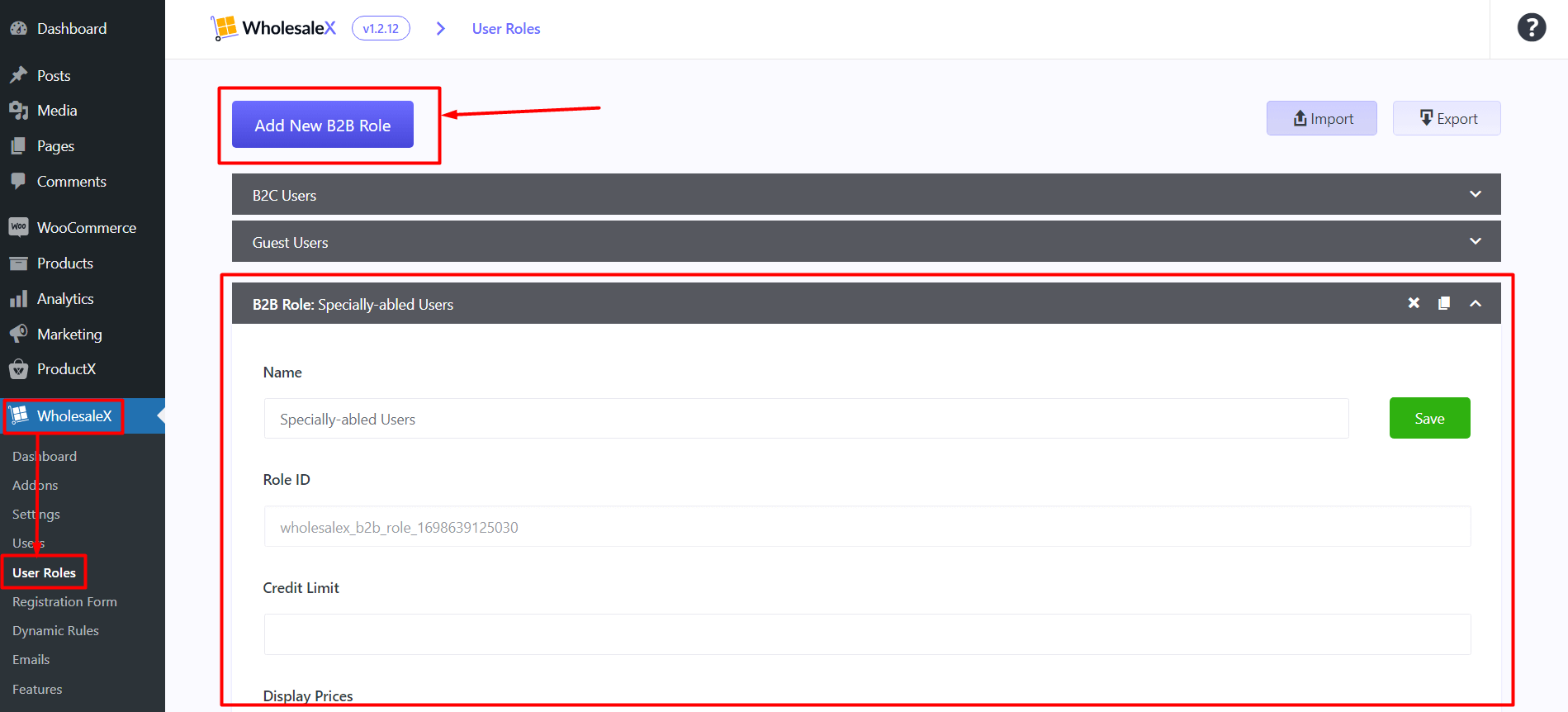

Step 1: Create New User Role

Navigate to the User Roles section within WholesaleX. Here, you’ll find that some default roles are already available. To create a new user role, click the “Add New B2B Role” button. This action will add an “Untitled Role” field that you can customize.

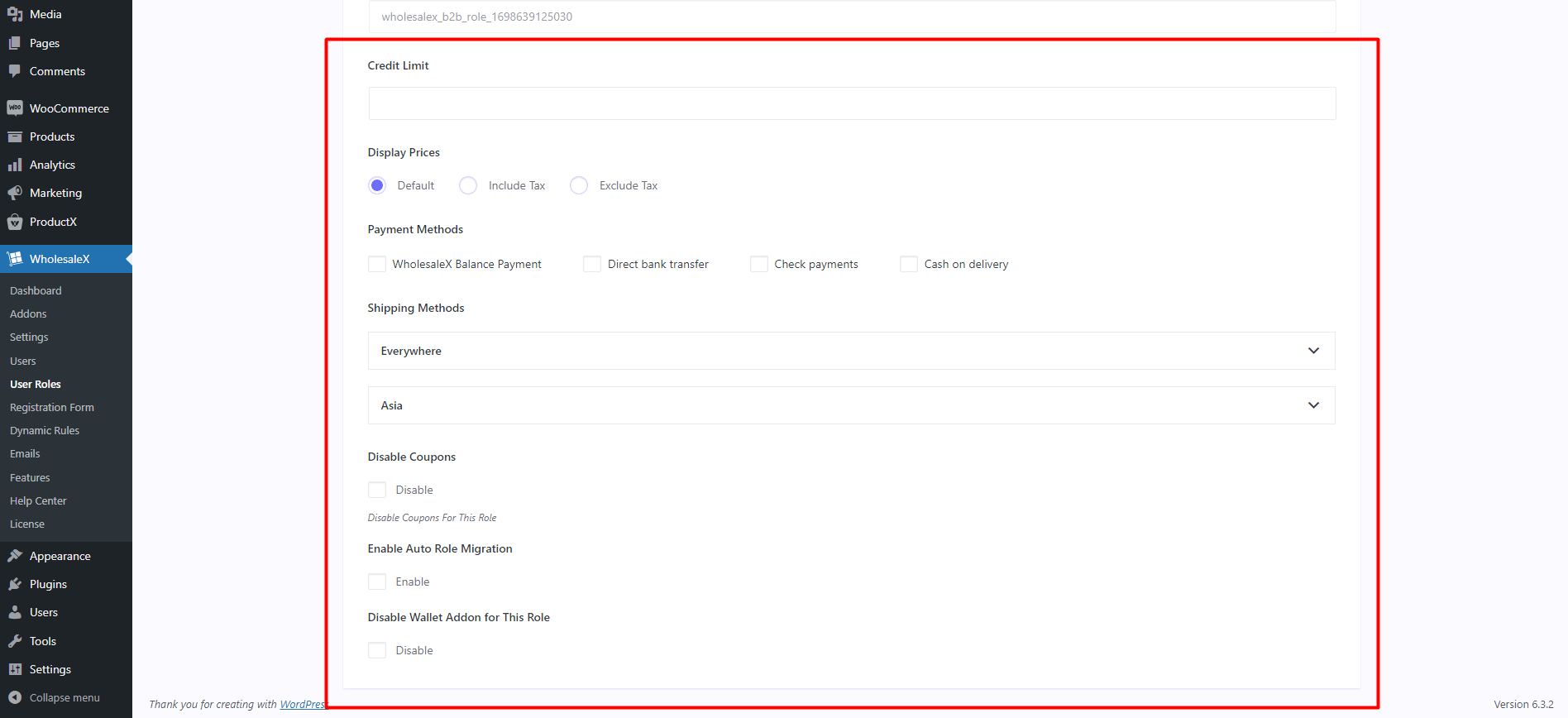

Step 2: Customize the User Role

Provide a name for the user role. Adjust other settings such as credit limit, display price, payment methods, and shipping methods, disable coupons, enable auto role migration, and disable wallet addon for this role. This flexibility allows you to customize to the unique aspects of disabled customers.

Don’t forget to check our in-depth guide on creating WooCommerce user roles.

Creating Tax Rule

You can create customized tax rules to add disability VAT exemption with WholesaleX’s Dynamic Rule. You have already created a User Role. Now, you have to create a rule and add the user role in it. Let’s see how to do that.

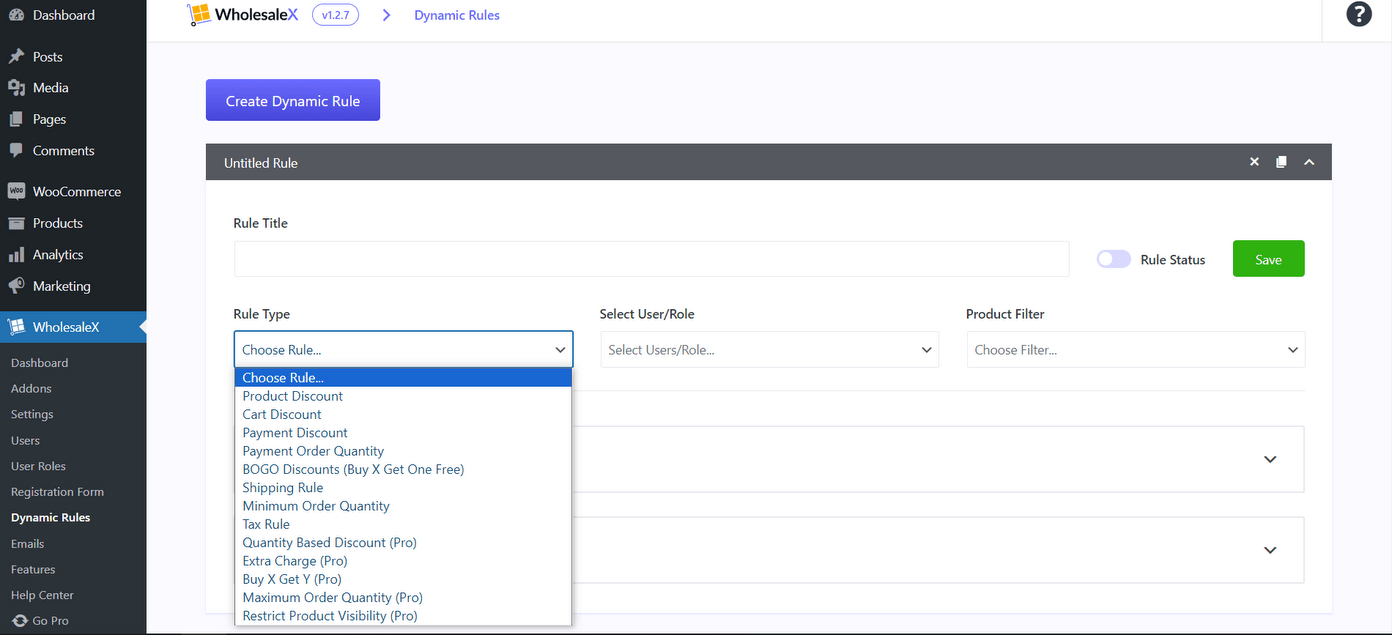

Step 1: Create Dynamic Rules

Go to WholesaleX→Dynamic Rules. This feature allows you to configure various rules, including tax exemptions, with ease. Click the “Create Dynamic Rule” button to create a new rule.

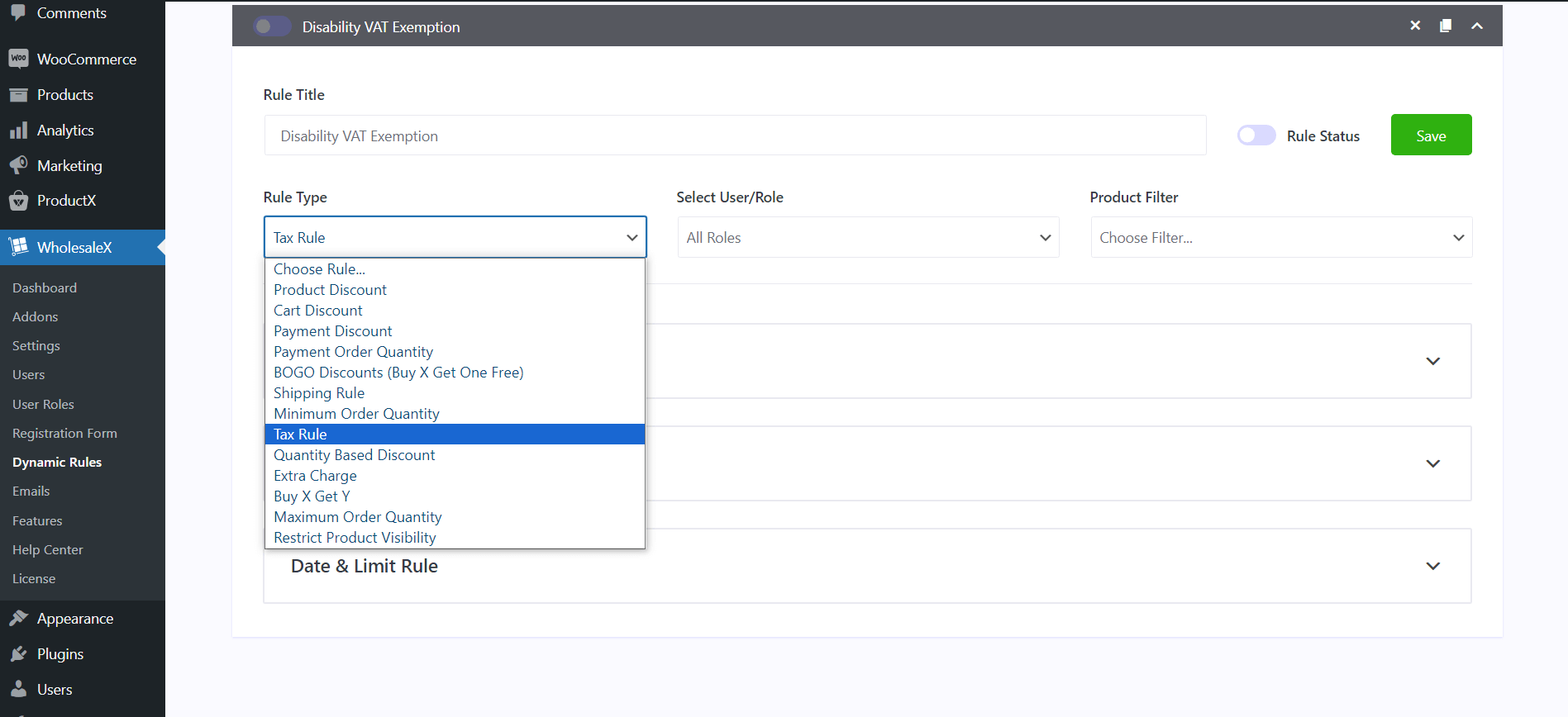

Step 2: Select Rules

In the rule configuration, select the “Tax Rule” option from the dropdown menu to set up a rule related to tax exemptions.

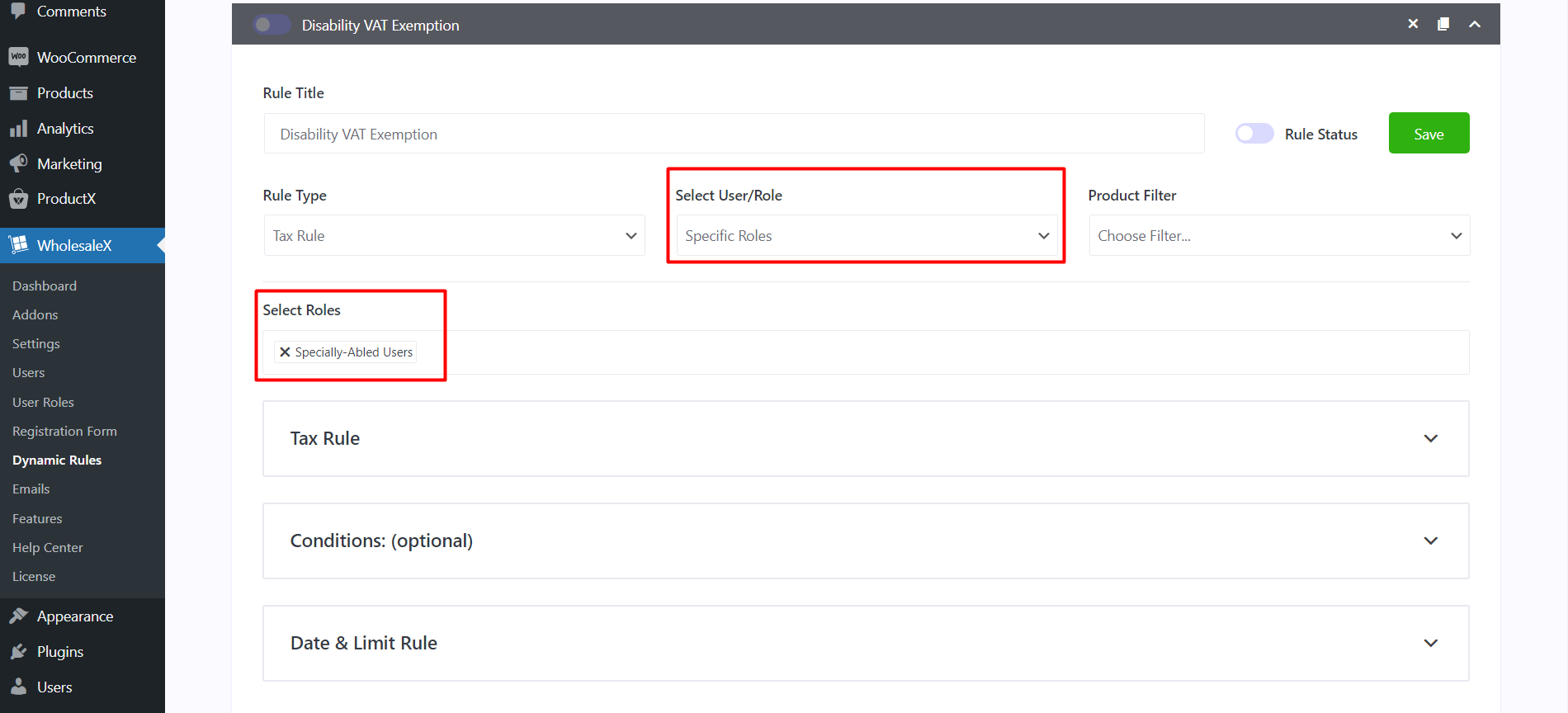

Step 3: Choose Roles

Select “specific roles” from the dropdown menu. And choose the role based on the user role you created for disabled customers. This ensures that the tax exemption applies only to the selected role.

Step 4: Filter Products

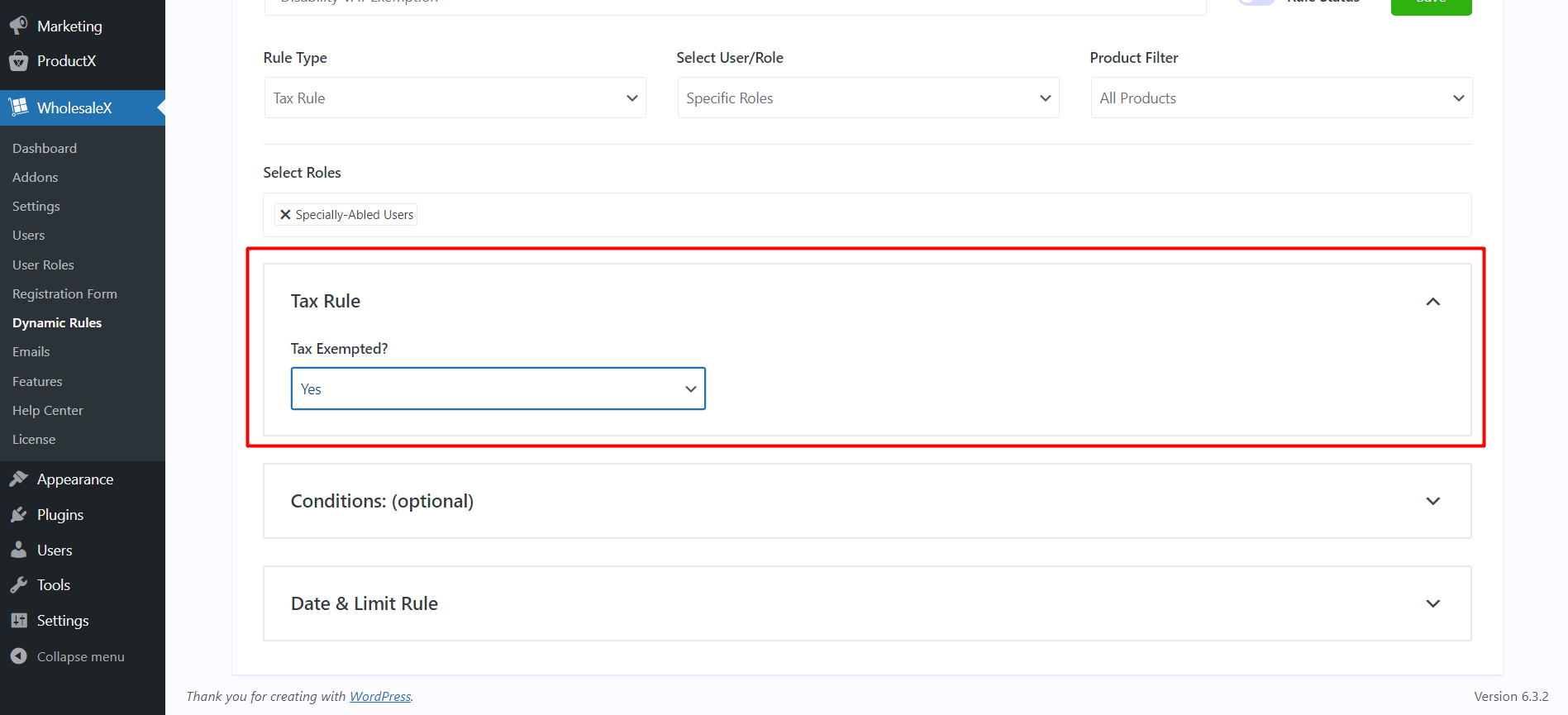

WholesaleX allows you to set tax exemptions for all products or specific ones. Filter the products, categories, or other criteria as needed to apply for tax exemption only where it’s required.

Step 5: Enable Tax Exemption

Under the “Tax Rule” section, you’ll find a “Tax Exempted?” dropdown menu. To grant disability VAT exemption, select “Yes” from this menu. This choice ensures that tax exemption is applied to the products associated with the designated user role.

By following these steps, WholesaleX makes it effortless to create a tax rule that exempts tax for your user role of disabled customers.

Conclusion

That’s how you can add disability VAT exemption to your WooCommerce store with WholesaleX. WholesaleX lets you provide a more inclusive shopping experience for specially-abled individuals. This makes it easier for them to buy essential products without the burden of VAT.

WholesaleX believes in community and bonding. It ensures compliance with VAT exemption requirements. This enhances the shopping experience for your special customers.

FAQ

Q: What type of disabilities qualify for VAT exemption?

A: People with disabilities and long-term illness, who cannot perform daily tasks qualify for the disability vat exemption.

Q: What products are eligible for VAT exemption?

A: Disability VAT Exemption applies to products used by individuals with disabilities. These include mobility aids, communication aids, and equipment for daily living.

Q: How do I set up a custom registration form with WholesaleX?

A: With WholesaleX, you can create a custom registration form with its form builder. You can add all the necessary fields to collect the required information from users to confirm their exemption status.

Q: Can individuals with temporary disabilities also benefit from VAT exemption?

A: VAT exemption is typically reserved for individuals with substantial and permanent disabilities significantly affecting their daily activities. Temporary disabilities may not usually qualify for VAT exemption.

Q: How do I ensure compliance with the UK VAT regulations when offering VAT exemption?

A: It’s crucial to stay updated with the latest UK VAT regulations. Consulting with a tax professional or expert can help you with the rules regarding VAT exemption for disabled individuals.

Q: Can WholesaleX handle other complex tax rules for my WooCommerce store?

A: Yes, WholesaleX is a versatile tool that can manage various dynamic rules and tax scenarios for your WooCommerce store. It’s not limited to disability VAT exemption; it can help with other tax and discount-related rules as well.